The global liquid applied membrane market is expected to reach USD 6.92

billion by 2022, according to a new report by Grand View Research, Inc.

Technical advancements in liquid applied membrane, when compared to traditional

systems, allow benefit in terms of cost reduction, better planning, and overall

concrete protection. Liquid applied membranes have immense market potential on

account of flexibility, making them ideally suited for application in water and

waste management systems.

European Commission announced favorable prices

governing the production of natural based polymer products such as biopolymers,

thereby enabling major players in the liquid applied membrane market to provide

environment-friendly solutions. Developing markets of Asia Pacific and Europe

are expected to account for over 50.0% share in global waste and water

management industry, further augmenting market demand for liquid applied

membrane. Governments of various developing and developed nations have

comprehended the dual need for infrastructure development, coupled with

sustainability and durability. This is driving the demand for green buildings,

consequently generating a vast market opportunity for the liquid membranes

market.

View

summary of this report @ http://www.grandviewresearch.com/industry-analysis/liquid-applied-membrane-market

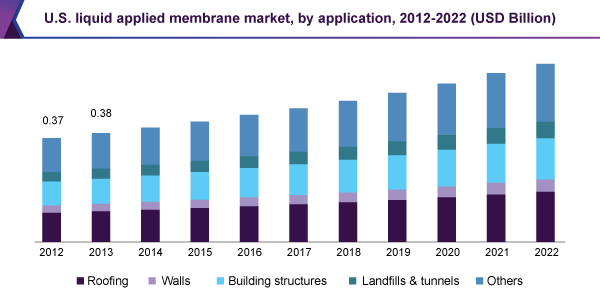

U.S. liquid applied membrane market revenue, by application, 2012-2022 (USD Million)

Further key findings from the report

suggest:

·

Cementitious membrane accounts for a significant

share owing to increased availability of polymer reinforced membranes which

allow superior quality at affordable cost. These membranes can withstand high

negative as well as positive hydrostatic pressure and provide excellent bonding

to concrete, which facilitates high-quality waterproofing. The segment is

expected to grow at a CAGR of 6.4% from 2015 to 2022.

·

Polyurethane membrane is expected to witness

rapid growth in demand on account of its superior properties including ease of

application, resistance to UV radiation, water vapor permeability, easy repair

& maintenance, and high mechanical strength. Companies have been

increasingly developing polyurethane based membranes to meet rapidly growing

demand. These accounted for over 12.0% of the global market in 2014 in terms of

revenue.

·

Roofing application dominated the market in 2014

and accounted for over 28.0% of total revenue share. Excellent physical and

chemical properties of liquid applied membrane coupled with rapid

infrastructural development worldwide are expected to increase penetration in

this segment over the forecast period.

·

Residential segment is expected to be the major

end-use on account of rising urban population and increasing infrastructure

investment by governments. Asia Pacific is expected to witness rapid growth in

this segment on account of growing trend of nuclear families in the region.

·

Asia Pacific market demand was over 250.0

million square meters and is expected to rise on account of increasing

requirement to an elongate life of building structures and protect the

infrastructure during severe environmental conditions. Governments have been

investing increasingly in the protection of historical monuments which is

expected to propel growth over the forecast period. In addition, increasing urban

population in the region is expected to facilitate residential construction,

thus driving demand for the product over the forecast period.

·

Europe accounted for over 30.0% of the global

market size and is expected to witness significant growth over the coming

years. The revival of European construction industry with rapid growth in

demand from the UK, Germany, and Nordic countries is expected to propel liquid

applied waterproofing utilization in the region over the forecast period. The

construction industry in Eastern European countries including Hungary, the

Slovak Republic, and Poland has also witnessed moderate growth over the past

years and is expected to have a positive impact on liquid applied membrane

demand over the next seven years.

·

Key market players highly rely on R&D for

new product development to sustain competition. The other major strategies

include joint ventures and acquisitions & mergers. In April 2014, INGE

GmbH, a subsidiary of BASF SE, entered into a strategic, contractual agreement

with Aquasource to synergistically improve their waterproofing solutions. In

August 2013, Pidilite Industries Ltd. acquired Suparshva Business Limited to

expand its adhesive business.

Browse All Reports of

this category @ http://www.grandviewresearch.com/industry/green-building-materials

Grand View Research has segmented the global liquid applied membrane market on the basis of product, application and region:

Global Liquid Applied Membrane Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2012 - 2022)

·

Cementitious

·

Bituminous

·

Polyurethane

·

Others

Global Liquid Applied Membrane Application Outlook (Volume, Million

Square Meters; Revenue, USD Million, 2012 - 2022)

·

Roofing

·

Walls

·

Building Structures

·

Landfills & Tunnels

·

Others

Global Liquid Applied Membrane End-use Outlook (Volume, Million

Square Meters; Revenue, USD Million, 2012 - 2022)

·

Residential

·

Commercial

·

Industrial

·

Public Infrastructure

Global Liquid Applied Membrane Regional Outlook (Volume, Million

Square Meters; Revenue, USD Million, 2012 - 2022)

·

North America

·

U.S.

·

Europe

·

Germany

·

UK

·

Asia Pacific

·

China

·

India

·

Latin AmericaMiddle East & Africa

·

Brazil

No comments:

Post a Comment